The influence of compensation with regards to insurance agents can best be summed by the phrase “Actions speak louder than words.” What we mean by that is that while agents consistently claim that compensation is not a driving force behind their decision making when placing business, the data shows that it does in fact play a significant role. We explored this unique dynamic in a recent webinar with experts from Celent, which you can view here.

Now, compensation is more nuanced than just a sum of money; other factors like pay structure, incentives, and schedules are important elements for agents to consider. For carriers, understanding how the various facets of their compensation programs affect both existing and potential agent relationships is vital to the success of their business. In this blog, we’ll look at a recent study published by Celent in partnership with Vertafore that surveyed more than 600 life and health insurance agents about compensation. We’ll break down agent wants and needs, what features matter most to them, and how carriers might better position themselves to attract and retain agents.

How does compensation structure influence agent behavior?

There’s no denying that at the heart of compensation is the payment amount; agents, like any employee, want to be paid well for their work. But thinking of compensation as simple dollars and cents glosses over several key details—ones that agents indicate actually matter quite a lot. Let’s look at some key findings from the report:

- 86% of agents say that personalized payment schedules, such as weekly, biweekly, or monthly options, are either “must-have” or “really important” when placing business. A similar percentage (77%) said the same for flexible payment frequencies.

- 22% of agents reported that only “some of their carriers” make it easy to handle recoupment, garnishments, and chargebacks. The same was said about fee deductions and advance recaptures, showing that there are inconsistencies with how carriers handle these compensation-related processes.

- Short-term bonuses were rated nearly as important as annual bonuses, but were also reported to be far less frequent, indicating a potential gap that could serve as an opportunity for carriers looking to provide additional incentives.

These statistics don’t just speak to the amount of money an agent is earning with their carriers, but the structure of their payment, the complexity of processes related to payment, and the incentives tied to their commissions. They illustrate the layers that make up compensation and how each layer can influence agents’ decision-making; carriers that are mindful of these influences can leverage them to improve agent relationships.

One area of compensation structure that has seen a consistent, upward trend in popularity and influence is contests. In the same study from Celent, 62% of respondents said they are highly motivated by contests and actively choose carriers running them. This preference transcends specific agency roles too, with 90% of agents, 89% of principals and owners, and 94% of agency staff reporting strong motivation to participate in contests when available.

This prioritization was also seen in Vertafore’s 2025 agent experience study, which found 73% of agents thought contests were either must-have or nice-to-have. That sentiment was even more popular among newer agents, with 53% deeming contests a “must have,” demonstrating a shift in preference for new generations. The specific structure and payout of these contests may be left to each carriers’ resources and incentive programs, but the fact remains that features beyond basic compensation amounts have a big impact on agents. To that point, the technology that helps organize, communicate, and handle these compensation-related features can play a role in influencing agent decision-making as well.

What are agents looking for in compensation technology?

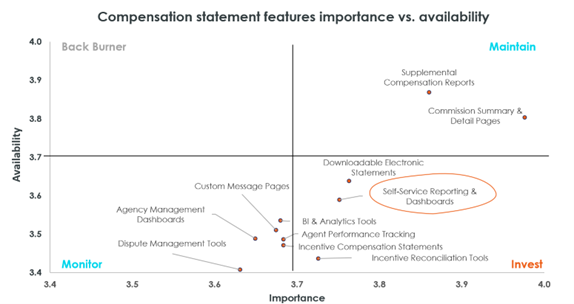

The relationship between what insurance agents want out of carrier compensation technology and the technology often provided leaves a lot to be desired—and the numbers support this. It also means that there are clear opportunities for those carriers to refine or revamp their compensation infrastructure to improve agent relations.

Placement Decisions, Celent 2025.

Let’s look at one feature from the aforementioned Celent study: Agents ranked “Self-Service Reporting & Dashboards” as high for importance but low for availability. This highlights a gap in digital capability that carriers could invest in and use to broaden their appeal to potential agents. By streamlining agent processes and giving them more independence to service their clients, carriers will be seen more as enablers than potential roadblocks.

Another opportunity agents noted was with “Downloadable Electronic Statements” which were also ranked as highly important but less available. This sentiment has persisted since last year, when it was noted in an agent experience study by Vertafore. In that study, 67% of agents ranked direct bill and commissions downloads as a “must have” when evaluating carriers. Together, these features represent key influences for agents placing business that are not directly related to the dollar value of their compensation. Carriers that are able to broaden their tech stack to accommodate the needs and wants of agents will find themselves with more business and improved agent relationships.

What can carriers do to improve compensation for agents?

The compensation landscape has evolved beyond simple commissions. Agents are looking for better experiences around payment flexibility, digital tools, and incentive programs—and they’re happy to jump carriers for better opportunities. Gaps in service and technology represent opportunities for carriers willing to listen and invest in faster, user-friendly infrastructure and clear, competitive compensation structures.

Successful carriers will recognize that their compensation strategy encompasses the full agent experience, from contest design to digital platforms and daily operations. Those who align investments with agent preferences will be better positioned to attract and retain top-performing distribution partners.

Vertafore’s Sircon Compensation provides comprehensive insurance commission tracking and customization that empowers carries with the speed and flexibility necessary for today’s markets. As a key element of our distribution management platform, Sircon Compensation is designed to motivate agents and strategically drive sales of products you want to prioritize.