By: Vertafore Data Science Team

Without a doubt, 2020 has been unique. The year began as most others, showing promise for continued economic growth as a nation and, by extension, the insurance brokerage and consulting industry. By mid-March COVID-19 had been introduced to the daily lexicon. Within a month, employers began implementing measures to comply with state and local regulations designed to slow the rate of viral infection, including telework, furloughs, and complete shutdowns. These actions have generated a natural question from the brokerage community: How has COVID-19 impacted employer-paid benefits?

COVID-19 and employer-paid benefits

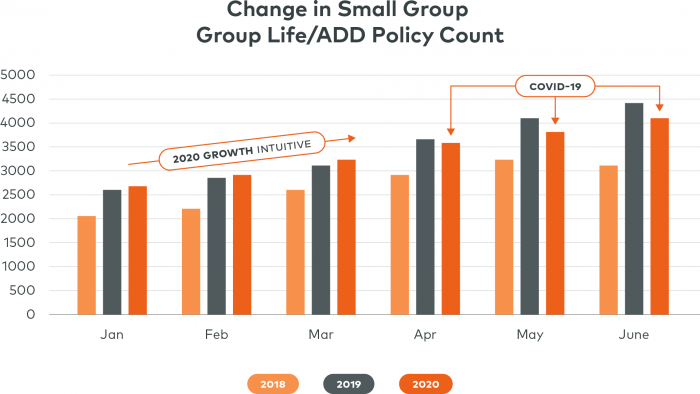

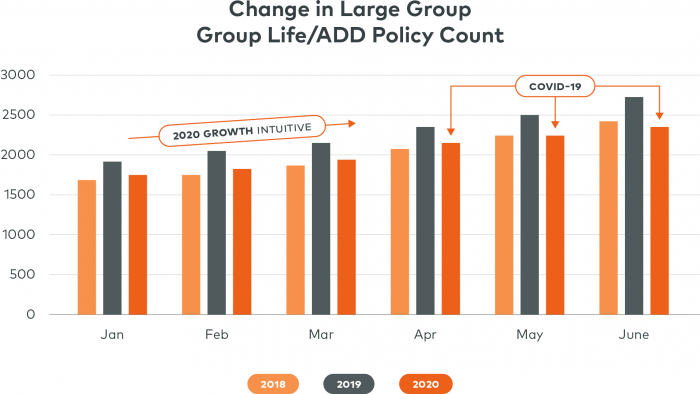

Using policy data within BenefitPoint™, the Vertafore data science team analyzed the number of employer-paid in-force Group Life/ADD policies in effect during the first half of 2020 compared to the same months in 2019 and 2018. This analysis showed a notable reduction of policies beginning in April 2020 that increased in May and June when compared to the same period in each of the prior two years.

The reduction of in-force policies was most pronounced in the small group market. The graph below shows the cumulative number of in-force policies in each of the first six months of 2018, 2019, and 2020. The first quarter of 2020 produced expected numbers of in-force policies. Beginning in April 2020, the number of in-force policies began to follow a different trajectory, coinciding with the COVID-19 employer compliance tactics. May and June 2020 continued the trend of divergence.

The same trend is noted for large groups, as shown in the graph below. Even though the year began with fewer numbers of in-force polices, a clear (but less pronounced) trend of slower growth coinciding with the COVID-19 restrictions is noted. Overall, BenefitPoint data showed fewer than expected in-force Group Life/ADD policies in June 2020.

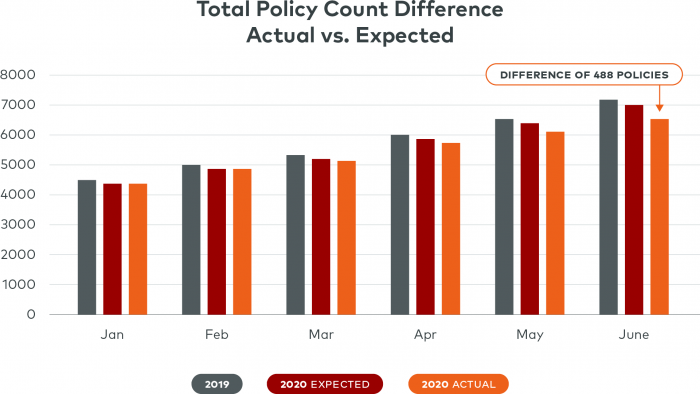

Vertafore also analyzed the trend by calculating the difference in actual in-force policy count and expected policy count. To do this, we projected the number of policies that might have expected given the same growth pattern as 2019. The actual in-force number at the end of June 2020 is 6,498 policies. Had 2020 experienced the same monthly growth rates as 2019, the expected policy count in June 2020 would have been 6,986: a difference of 488 policies, or an overall reduction of 7% versus expected. Results of this analysis are shown below.

An examination by group size shows small group policy count was affected disproportionately with an 8% reduction, or 379 fewer polices, versus expected. Large group policy count was reduced by 6%, or 139 policies, versus expected. Downstream effects of this policy count reduction obviously are not limited to Group Life/ADD in employers who partially or wholly shut entire benefit plans down. Such outcomes are disappointing both for the laid-off/furloughed workers, and for the agencies who broker their benefits.

Employer-paid benefits track with unemployment

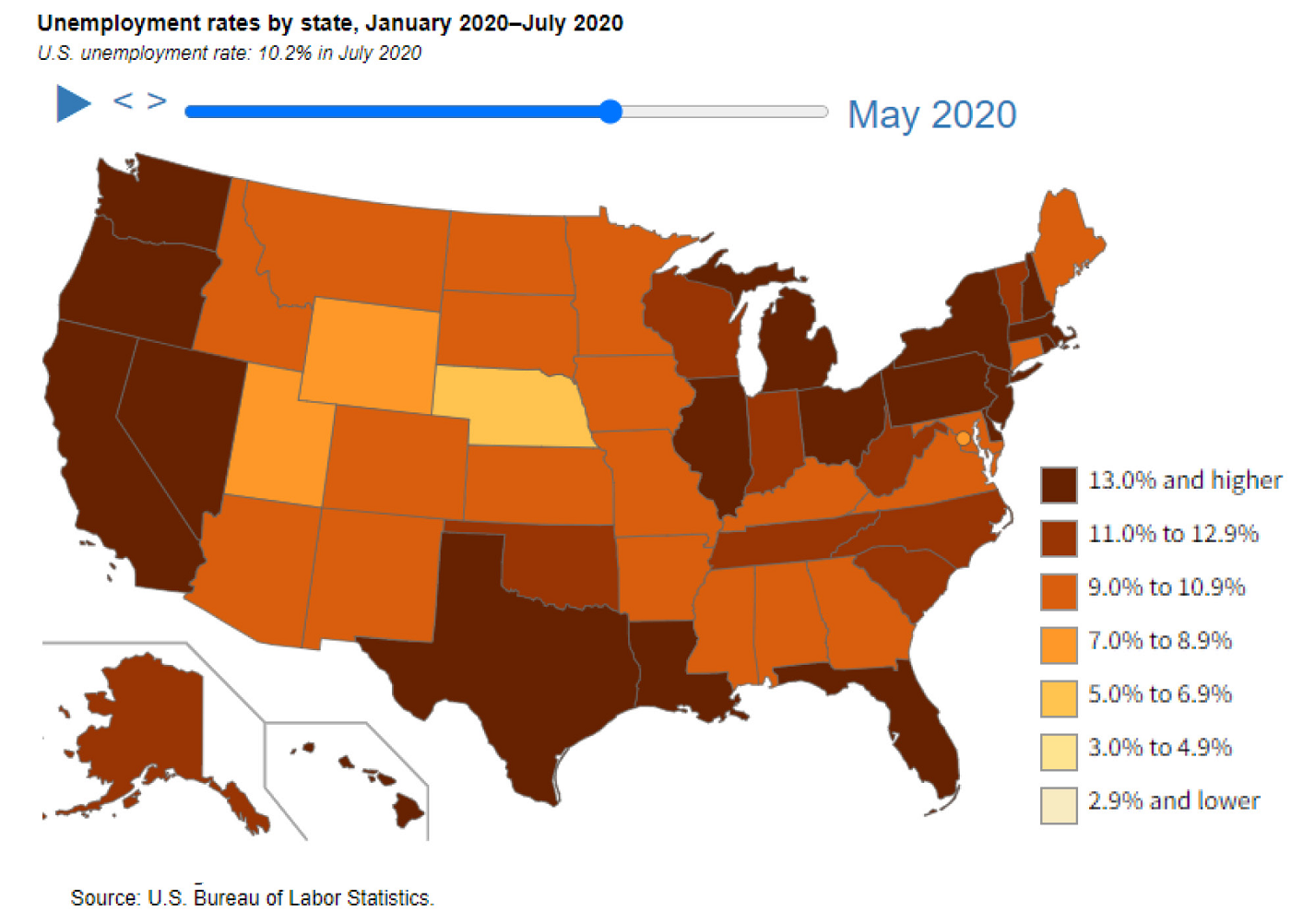

Comparison of BenefitPoint in-force policy count data with unemployment statistics reveals a consistent correlation. Policy counts followed the unemployment rate. The sharp increase in unemployment in April 2020 marked the beginning of lower policy counts in BenefitPoint through the June timeframe.

This video timeline illustrates unemployment rates by state, January 2020–July 2020.

More recent unemployment data from the Bureau of Labor Statistics shows improving conditions for workers and employers. The monthly unemployment rate has improved consistently since April with the August 2020 rate of 8.4%, down from April’s peak of 14.7%, consistent with the policy count growth in BenefitPoint. Given this improvement in national employment conditions we expect to see continued improvement in BenefitPoint policy count in the coming months. Vertafore will continue to monitor the COVID-19 impact on policy count and report new findings as 2020 progresses.

About the Vertafore data science team

The Vertafore data science team works to uncover insights within the insurance industry and leverage those insights to benefit Vertafore customers and the industry.