The latest installment of our annual insurance agency workforce whitepaper details findings from a survey of more than 1,000 independent insurance professionals in the U.S. Last month, we gave you three positive takeaways for 2021. This month, we are looking at where the industry can improve based on our findings.

1. Employees need flexibility

For our survey respondents aged 24–39, an overwhelming 63% indicated they would leave the insurance industry for a better work-life balance, and many reported high levels of stress, burnout, and anxiety.

The industry is ripe for improvement in flexible work options. This need for more workday flexibility is not new, but it has grown in the face of the COVID-19 pandemic. Now that employees have a taste of working from home and the benefits that flexibility provides, many of them won’t want to go back to the old ways.

2. A fear of change still lurks

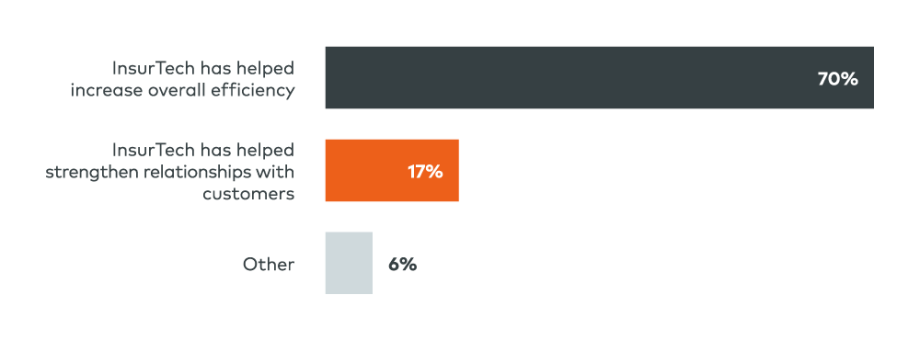

While most agencies say InsurTech has helped with efficiency and customer relationships, the industry continues to be slower in adopting new solutions. Many resistant agencies report a fear of being replaced by a technology or losing the personal touch with clients.

Technology solutions, when implemented strategically and with sufficient training, can enhance relationships and increase operational efficiencies. Technology is not meant to replace the agent; rather, it is meant to provide a value-add for the agency and thereby increase profitability and attract and retain new talent who recognize the benefits of InsurTech.

3. Self-service tools are lacking

Less than a third of respondents reported that their agency has a self-service portal or app in place for their end-insureds to access documents. Half of the surveyed agencies have no self-service capabilities available for clients, and a small but notable portion rely on self-service tools provided by carriers.

Further, less than 17% of respondents use a portal or app to communicate with clients, and only 1 in 5 report using a form of automated communications with their client base. As clients increasingly look for quick, easy self-service processes, the independent agent channel must keep up to compete with big box companies.