A few things to consider

When purchasing an AMS and CRM together, there are a few other things to consider:

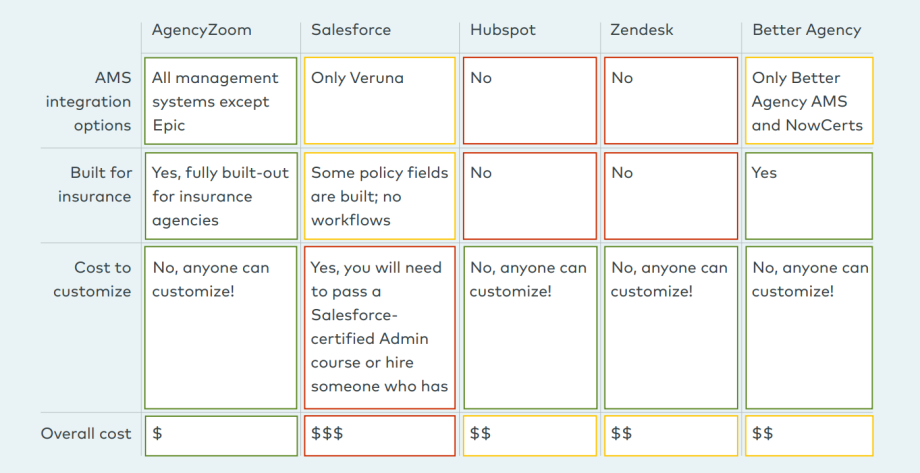

Are they integrated?

While you might love a good DIY project, when it comes to integrations, it might be best to leave that to the experts. That's why making sure that your AMS and CRM are pre-built with integrations that you’ll need is important!

Otherwise, you’ll have to set up integrations yourself to connect your insurance tech, which isn’t always easy and usually comes at an additional cost.

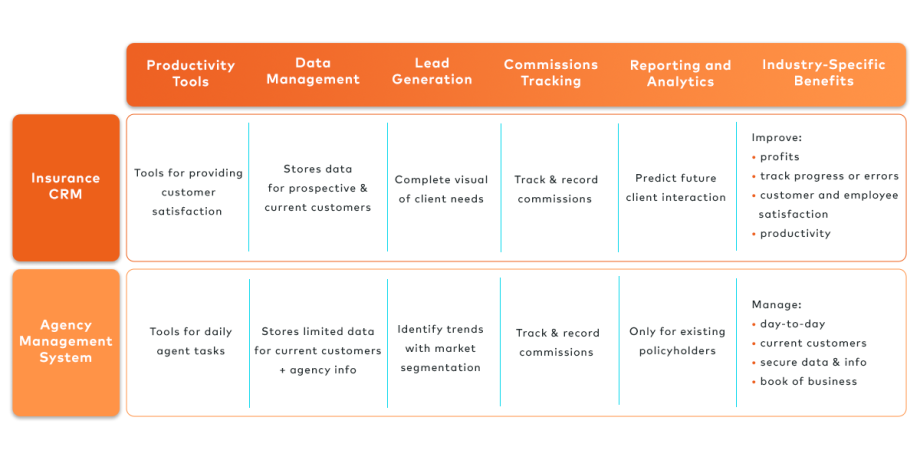

Is your CRM insurance-specific?

This might seem obvious, but a CRM that isn’t specifically designed for insurance agencies isn’t going to have all the capabilities that you need.

While a general CRM will do the job initially, in the long run it isn’t the most practical for operating your agency at the highest efficiency. Eventually you’ll probably want to make the switch to an insurance-based CRM, and deal with re-learning, implementing, and transferring data.

In this case, it’s best to go with an insurance specific CRM, to save you time, money, and productivity in the future!