First and foremost, what exactly is an InsurTech MGA? It’s a company that combines the traditional role of an MGA with the flexibility and custom solutions of insurance technology, which allows them to better serve the niche markets in which they operate. InsurTech MGAs are driven by modern core systems and technology to tap into new markets, create innovative products, develop new distribution strategies, and provide superior customer experience.

In our recent webinar, Rising tide: Why InsurTech MGAs are making waves, we took a deep dive into InsurTech MGAs, exploring how market dynamics are fostering new potential, how their trailblazing effect is influencing the industry, and where they are focusing investments to drive digital transformations.

We covered a lot of interesting insights in the webinar but here, we’re narrowing the scope to look at:

- Which types of new insurance products are being prioritized and why.

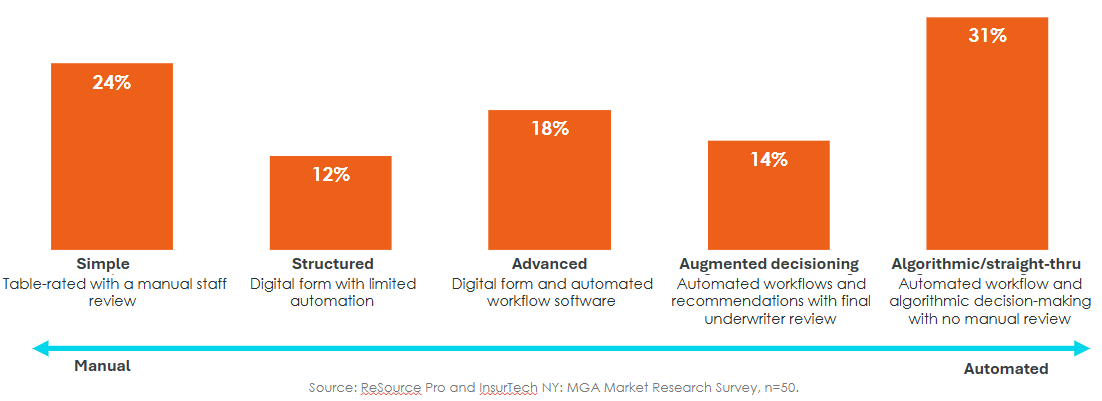

- The degree of automation and impact of AI on internal processes.

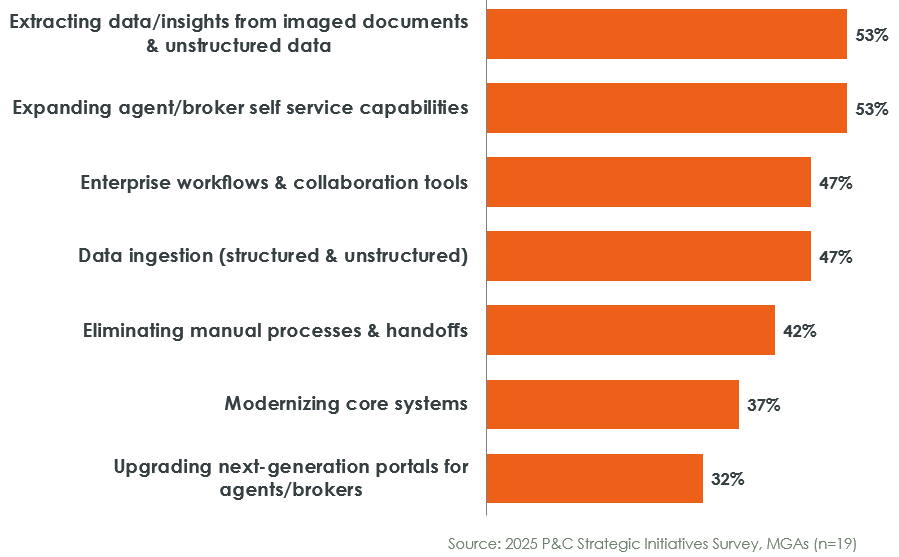

- Focal points for upgrading systems and solutions.

What types of new insurance products are InsurTech MGAs prioritizing?

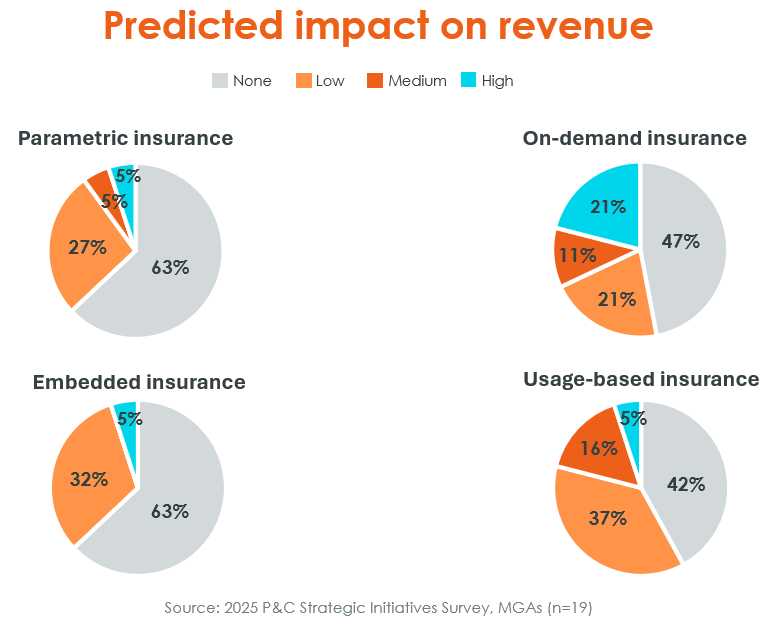

Let’s look at four specific insurance products that InsurTech MGAs are focusing on, and how much of an impact they might have on revenue:

- Parametric insurance – Coverage provided in a predetermined amount based on when an event occurs, rather than the damages that result from the event itself. A common example is with extreme weather or geological events, such as a hurricane measuring a Category 4 or an earthquake registering a 7.0 magnitude.

- Embedded insurance – Coverage provided in conjunction with another product or service being sold from a separate party, such as insurance on airline tickets.

- On-demand insurance – Policies that can be turned “on” and “off” by the insured party based on their needs, and that are only paid for when active. For example, professional photographers can turn on coverage for their equipment when traveling for work.

- Usage-based insurance – Also known as telematics, this coverage is based on specific policyholder behavior, rather than traditional factors, and while popular with auto insurance, can be utilized for other lines.