Agency professionals want to see AI in action

Generative AI is changing how work gets done in insurance. Carriers have been actively adopting AI to drive efficiencies and better outcomes in everything from workflows to underwriting.

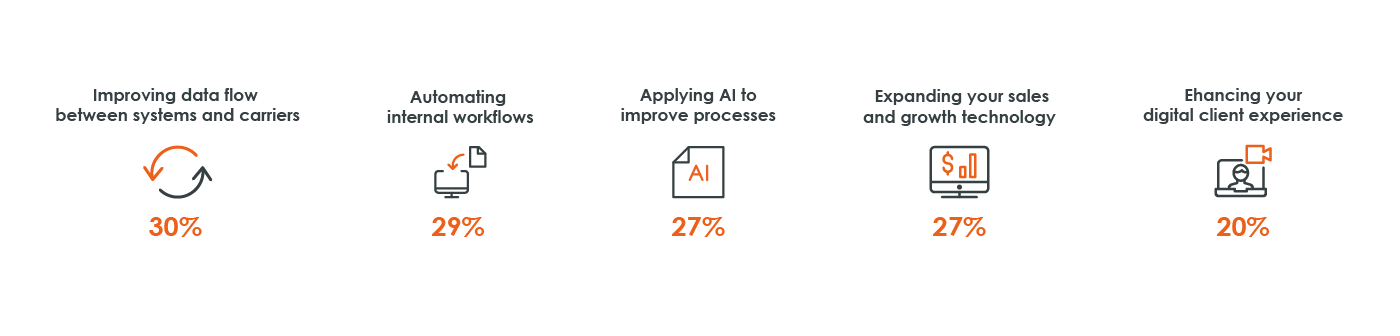

Now, in 2026, many agencies are poised to bring AI into their work to reduce manual work and uncover new growth opportunities.

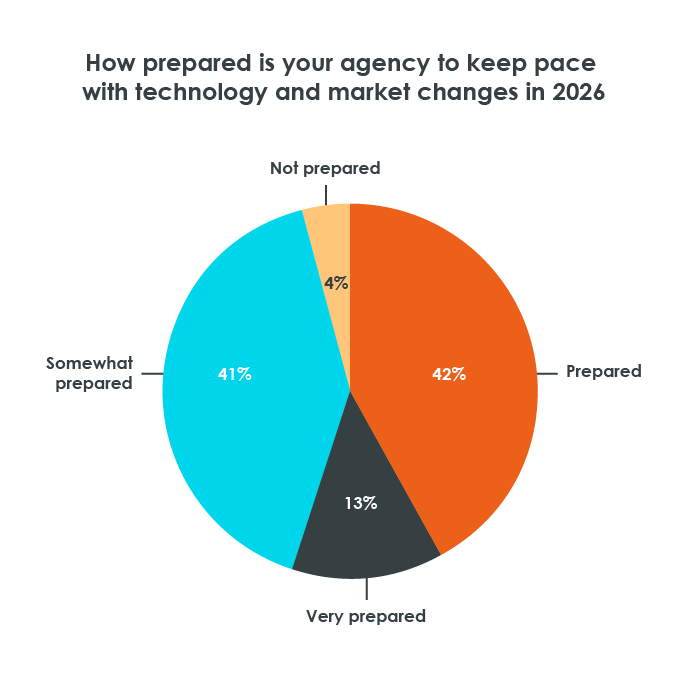

Almost a quarter of our respondents are confident that AI will transform everyday work for agencies in 2026. And 39% believe agencies will spend the year exploring use cases and building up their AI knowledge. That outlook is consistent across agency sizes.

If you’re among the agencies already testing AI, the biggest opportunity is in moving AI programs beyond the pilot stage and into everyday workflows.