Vertafore’s latest survey of independent agents highlights need for remote work options, time-saving technology and an inclusive workforce to attract and retain industry talent

DENVER (March 1, 2021) — A new report by Vertafore on the state of the independent insurance channel workforce brings into sharp relief how the pandemic changed the nature of work in the industry, what insurance professionals value about their work and what independent agencies can do to support their people now and attract new talent in the future.

The Insurance Agency Workforce: Ripe for Flexibility, Innovation, and Investment in People details the results of Vertafore’s fourth annual survey of the independent insurance agency workforce. The report’s key findings show:

- Agencies may need to reassess the future of the five-day-a-week office culture

- Insurance professionals continue to find their work rewarding but also reported more stress in 2020

- Compared to previous surveys, fewer respondents plan to stay in the industry for more than 10 years and many are eyeing retirement

- Core InsurTech solutions are helping insurance professionals to be more efficient, but adoption of more modern tools remains modest

- Agents ultimately want more time in their day for meaningful client interactions

The future of work

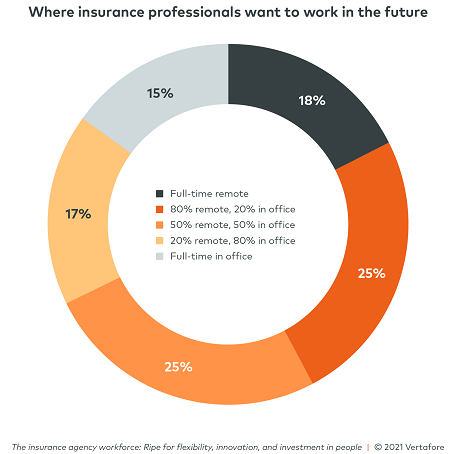

Not surprisingly, the majority of respondents reported working from home at least part-time during the pandemic. That may have implications for the future of office culture. When asked about their ideal work environment, just 15% of respondents said they want to go back to the office full-time. Two-thirds of respondents would like some mix of time at home and in the office, while nearly 1 in 5 want to work fully remote.

“Organizations will need to listen to their people and keep an open mind for what the flexible workplace will look like in the future,” said Kristin Nease, VP of Human Resources at Vertafore. “There is no one-size-fits-all solution. Organizations need to have open, authentic conversations with their team about what will and won’t work for their people and their business.”

A stable industry centered on helping others

As in past years, respondents said their favorite aspects of working in insurance are the “ability to work directly with my community” and “compensation/financial stability.” Some respondents also commented on the industry’s employment stability in the face of COVID-19.

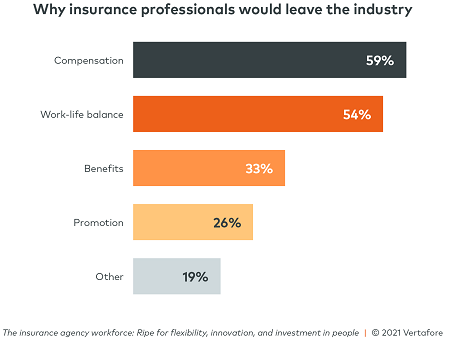

Most (85%) would recommend a career in insurance. However, many also stated that the industry is stressful and were more conditional about recommending a career in insurance to a friend. More than half (54%) would leave the industry for a better work-life balance.

Trends in InsurTech and agency modernization

When it comes to technology, a clear majority of respondents (70%) said that InsurTech has increased their overall efficiency and 17% believe it has strengthened their client relationships. Most respondents also believe their agency is keeping up with tech advances.

Respondents believe three modernization trends hold the most promise for agency growth:

- Automating repetitive tasks so they can spend more time with clients

- Adding a client digital experience, including client self-service portals, mobile apps, web chat tools and automated client communications

- Improved connectivity in the distribution channel to be able to service clients easier and faster

How independent agents want to spend their time

These modernization trends can free up time for insurance professionals to focus their energy on what they see as their most important function. When respondents were asked what they would do with more bandwidth, the most common answer, by far, was more meaningful communication with clients and acting in a more advisory role.

The “silver tsunami” is imminent

The Vertafore study made it clear that agencies are facing a huge transition in talent. Respondents aged 56 and older made up 35% of those surveyed, while only 25% of respondents were under age 40. That gap reinforces findings from previous years that show the industry is aging and isn’t attracting enough young talent to compensate for older workers who are nearing retirement. Based on survey results and industry research, the report notes agencies can invest in three primary areas for recruitment and retention: women, young people and diversity and inclusion.

“The insurance industry will have to get creative when it comes to filling the huge people shortage we are facing now and in the coming years as the older generation retires,” said Nease. “We need innovative solutions, and we need to align with what is important to a younger and more diverse group of people.”

About Vertafore

As North America’s InsurTech leader for more than 50 years, Vertafore is modernizing and simplifying insurance distribution so that our customers can focus on what matters most: people. Vertafore’s solutions provide end-to-end connectivity, improve the client and agent experience, unlock the power of data, and streamline essential workflows to drive efficiency, productivity, and profitability for independent agencies and carriers. For more information about Vertafore, visit www.vertafore.com.

©2021 Vertafore and the Vertafore logo are registered trademarks of Vertafore. All rights reserved. All other trademarks are the property of their respective owners.

For media inquiries please reach out to INK Communications at vertafore@ink-co.com