Background

In 2017, just 14 days apart, Hurricanes Irma and Maria wreaked havoc on the U.S. Virgin Islands. Marshall & Sterling, with offices on St. Croix, St. Thomas, and St. John, dealt with the aftermath by providing dedicated people who worked with specialized technology.

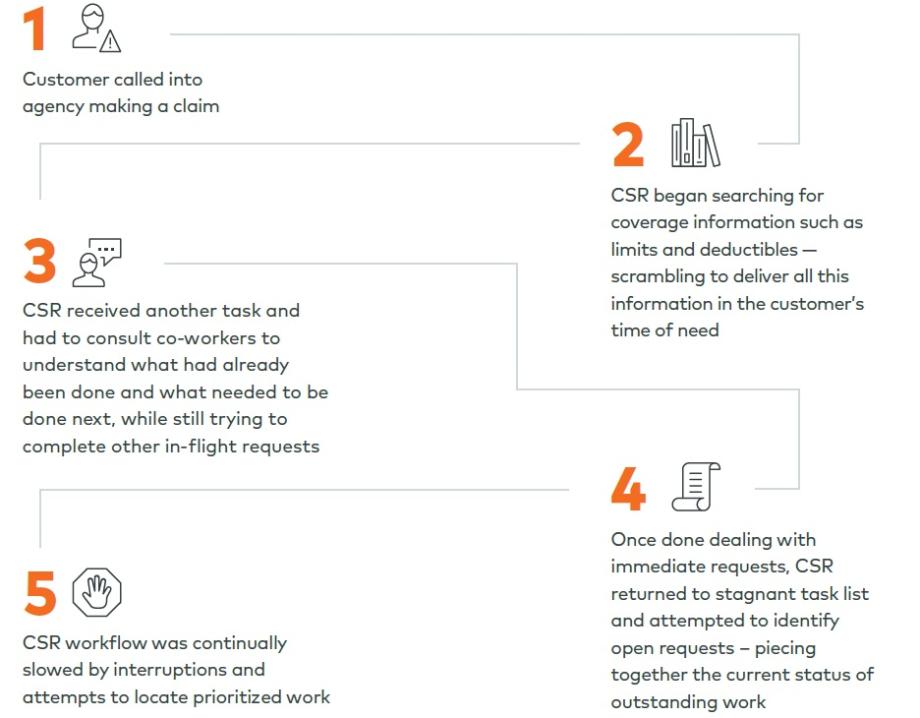

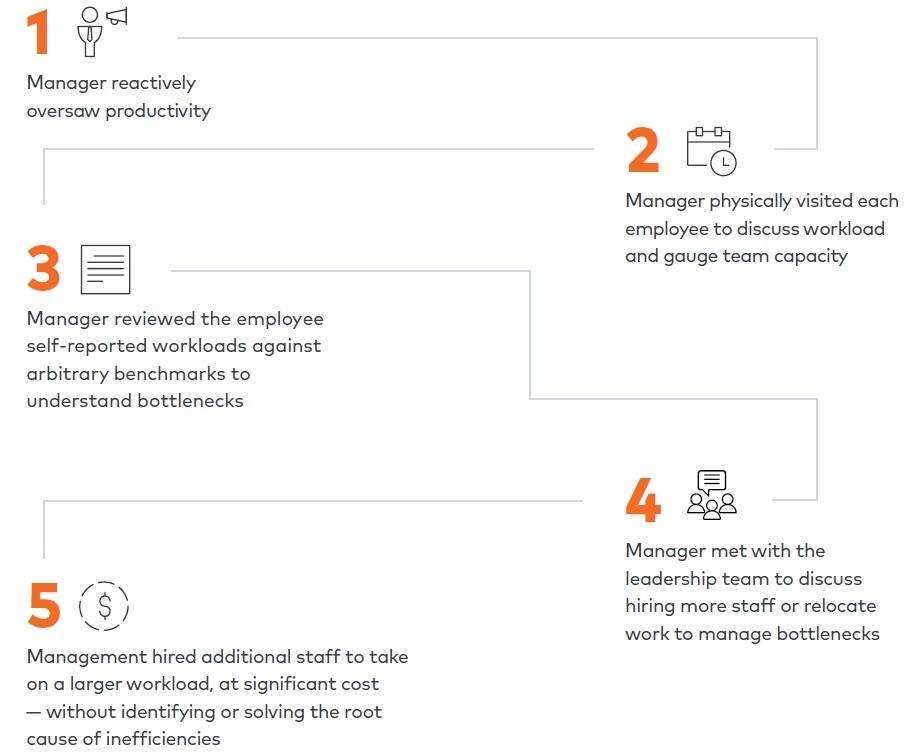

Dealing with catastrophes is a massive challenge for the entire insurance industry. When disaster strikes, carriers and agents deal with claims surges and anxious clients, which can become overwhelming. Add the stress of damage to the agency, and things can quickly seem out of control.

A much-needed helping hand

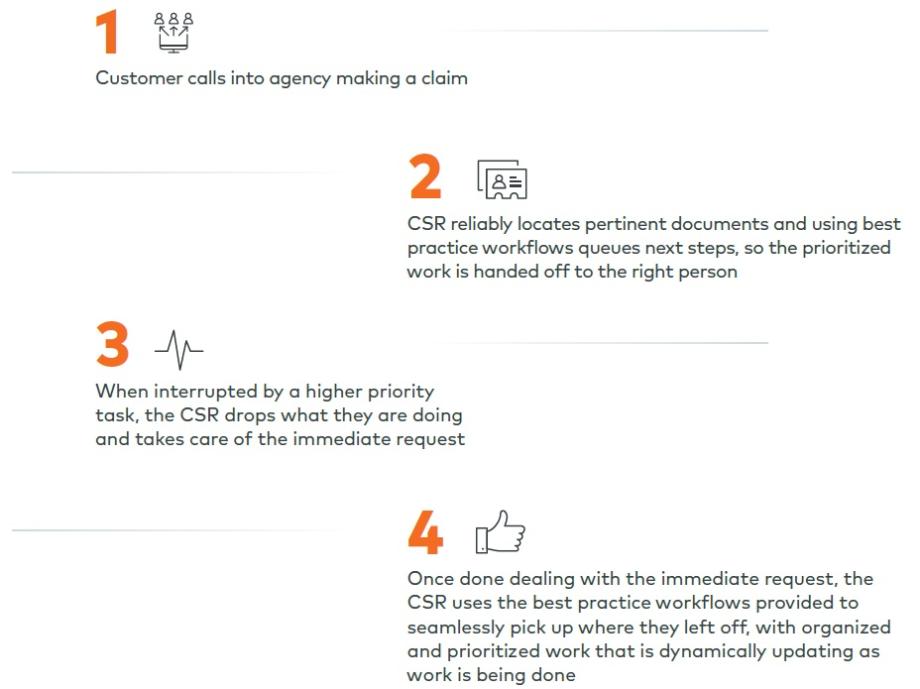

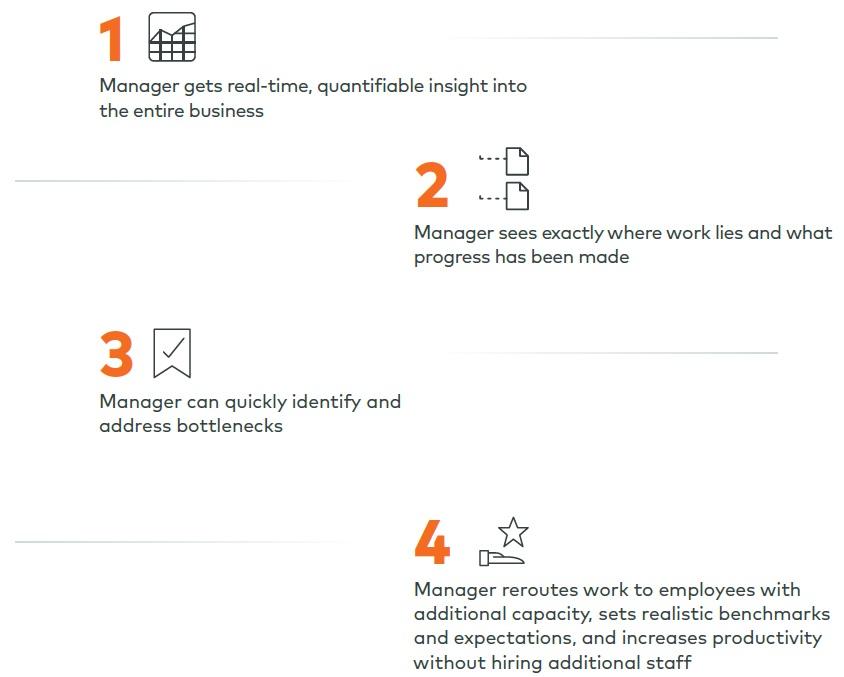

Jim Dahoney, Senior Vice President and Chief Information Officer at Marshall & Sterling leaned on his staff and technology to get through the tough times. The agency leveraged WorkSmart to respond to and process more than 7,000 claims in the wake of the storms. "I’m glad we made the switch to a tool that enabled us to track our processes, report in real-time, and automate the crushing flow of information."

“Vertafore’s WorkSmart enabled us to provide additional support both onsite and remotely to share the workload, give some relief to local staff, and meet our customers’ needs.”

– Jim Dahoney

SVP, CIO, Marshall & Sterling Insurance, Inc.

Marshall & Sterling ensured they took care of clients in their time of need without overwhelming the staff. It came down to having a solution that could distribute work across different departments and locations, organize vast amounts of content, and manage bottlenecks.