SeibertKeck Insurance Partners was founded in Akron, Ohio in 1910. The rapidly growing independent agency has 18 locations across Ohio and Florida and offers full-spectrum coverage in the personal, commercial, and benefits space. SeibertKeck Insurance Partners adopted InsurLink to provide modern self-service capabilities to their clients and enhance the customer experience.

Company snapshot

As we grow, we need that expertise to help us put our organization together and that’s why we lean on Vertafore.

- Joyce Sigler,

System Intellegence Manager, SeibertKeck Insurance Partners

Engage Clients

Vertafore solutions

Proven Results

- Increased customer retention by offering self-service capabilities

- Reduced costs associated with processing physical checks

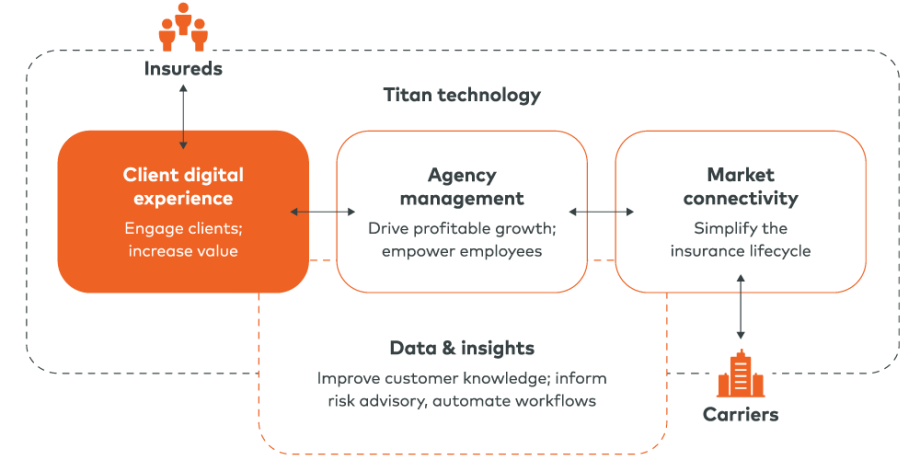

SeibertKeck Insurance Partners is focused on improving their client digital experience. As such, they’ve partnered with Vertafore to drive client engagement and increase the value of their client touchpoints.

Background

Joyce Sigler was part of Jones Wenner Insurance Agency which merged with SeibertKeck Insurance Partners in 2018. As System Intelligence Manager, she was tasked with building a strong foundation with all the recently acquired agencies. "We had bought and bought and bought but hadn’t positioned ourselves to grow. We had to look at what we needed internally and also how to be customer-centric."

Sigler elaborates on the struggles of fastpaced growth and the toll it takes on an agency’s ability to provide excellent service. “When you grow so fast, you go from this family-oriented small agency to this big business,” she says. “We wanted to keep the small agency culture as we grew.” Sigler knew that providing a self-service portal to her customers would provide the strong relationships and service of a small agency to her large client base.

SeibertKeck Insurance Partners turned to Vertafore for a solution. “We decided to partner with Vertafore because it’s the partnership that helps us run our ship,” Sigler adds.

“As we grow, we need that expertise to help us put our organization together and that’s why we lean on Vertafore.”

- Joice Sigler,

System Intelligence Manager,

SeibertKeck Insurance Partners

Self-service misconceptions

Agencies often hesitate when they hear the term ‘self-service.’ It holds the connotation of cold automation — removing employees from the equation. However, this could not be further from the truth. Sigler says:

InsurLink is not going to take your employees’ jobs. It’s going to enhance their roles and let them be something more to your clients.”

With less time answering simple inquiries, SeibertKeck Insurance Partners employees can provide more value to clients and further enhance the customer experience. Another misconception is that only the younger generations want to use self-service. But self-service has become the go-to for every generation whether it’s using an ATM or purchasing an item from Amazon. As Sigler elegantly puts it, “Everybody has a need for immediacy at some point in their lives.

Meeting customers where they are

SeibertKeck Insurance Partners writes a lot of niche trucking business. As one might imagine, truckers often need to show certificates of insurance before loading up. InsurLink allows Insurance Partner’s trucker customers to retrieve their own certificates, right from their smartphones. “Instead of calling the agency, our customers can be on the loading dock, get the certificate from InsurLink, and send it straight to the loading dock folks,” Sigler says. “Our customers have their business needs and we want to meet them there.”

Happier customers; increased retention

SeibertKeck Insurance Partners Vice President and Controller Kevin Speight likes InsurLink for another reason: customer retention. He says:

Our customers are linked to us and are less likely to look at someone else because they have this portal set up. It’s so convenient that they don’t want to leave us and deal with another agency that doesn’t have the self-service capability.”

SeibertKeck Insurance Partners has between 145 and 250 customers logging into InsurLink every 30 days. How many agencies can say they engage with that many customers in a month? “Without the phone ringing, without interruption, we’re still ‘talking’ to our customers,” Sigler says. For every customer login, that’s another client engagement where they receive service, see the SeibertKeck Insurance Partners logo, and further solidify their relationship with the agency. Sigler adds, “That touchpoint is as important and powerful as picking up the phone.”

Retention is a priority for every agency and providing these simple but effective engagements can significantly improve the chances that a customer stays satisfied. Speight elaborates on the importance of retention by saying, “If you have seven percent turnover every year, to get three percent growth, you have to actually add 10 percent of business every year.” InsurLink gives SeibertKeck Insurance Partners the ability to retain more customers to meet their growth goals, and according to Speight, "gives us that edge over our competitors."

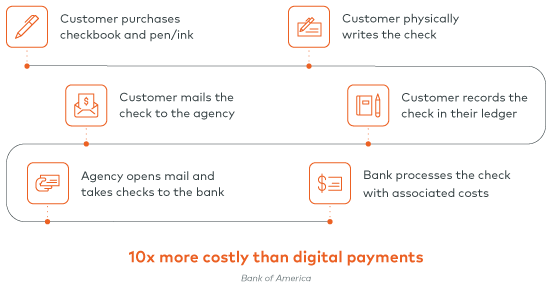

Insurlink payments

InsurLink has simplified the way SeibertKeck Insurance Partners’ clients interact with their agency, including the way they pay their bills. InsurLink integrates with digital payment platform ePayPolicy, allowing insureds to send payments through the InsurLink web portal or app. “We don’t have people opening mail and sorting checks and taking them to the bank,” Speight says. “It’s all done electronically. It’s streamlined and handled so much more efficiently.”

Not only can SeibertKeck Insurance Partners pass the savings from digital payments onto their customers, but it also eliminates any security risks involved with physical checks. “It’s a more secure way of doing things than putting a check in the mail, where someone can steal your account information,” Speight says. “Even with ACH, where you’re sending forms through email, there’s a lot of risk associated with that. Paying digitally through a secure network really gives people a sense that we care about their security and privacy.”

Digital payment is a very cost-effective way of paying bills. Many of our customers are already used to it with their other bills like their mortgage or utilities. It’s certainly time for us to make it easy for them to pay electronically as well.

- Kevin Speight,

Vice President & Controller,

SeibertKeck Insurance Partners

Innovative solutions for the modern agency

Insurance is evolving: The industry is quickly consolidating, as client expectations grow, and technology creates new opportunities. The key is staying ahead to remain relevant and profitable. If you’re unsure how to move forward in this evolving landscape, Vertafore is here to be your partner and guide you through these changes.

Ready to take the next step?

Contact us to learn more about how Vertafore can help you provide your clients with the digital experience they expect.

Posted June 9, 2023 in Success Stories