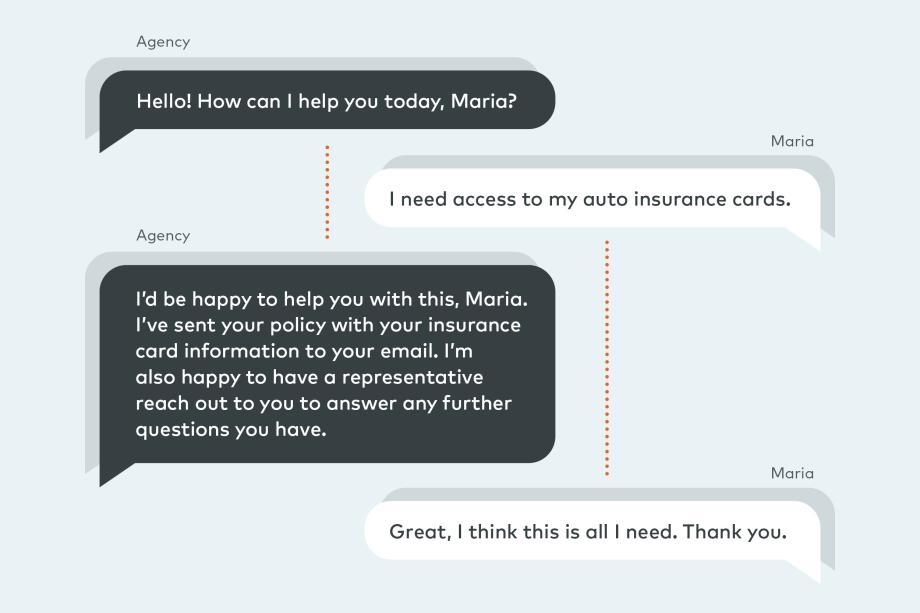

It was a dark and stormy night. After putting the kids to bed, Maria remembered she needed to print her auto insurance cards. Glancing at the clock, she saw it was 10 p.m., well past the open hours of her car insurance agency. But fear not! She remembered the agency recently added a chatbot tool, allowing her to receive help at any time. She quickly connected with a chatbot, which helped her gain immediate access to her cards.

Communication is a pivotal part of independent agencies maintaining lasting relationships with end-insureds. This is especially true in a 24/7 world, where clients expect services at any time of the day or night, just like the example above.

This 24/7 access underscores the evolving client expectations in the insurance industry, where people expect instantaneous help without having to speak to someone directly. PropertyCasualty360 recently highlighted this expectation in their article on top InsurTech trends of 2021, and listed chatbots as one of the top tools booming in the InsurTech space.

Meeting the end-insureds where they want to be met

Chatbots—a computer program that stimulates human conversation through voice commands or text chats—are one of the common forms of artificial intelligence (AI). By harnessing stored data and user information, the chatbots can quickly identify problems and provide solutions to customers.

This tool has increased in popularity in recent years due to the value they bring to the customer experience. In fact, around 60% of millennials already use chatbots regularly to purchase basic goods.

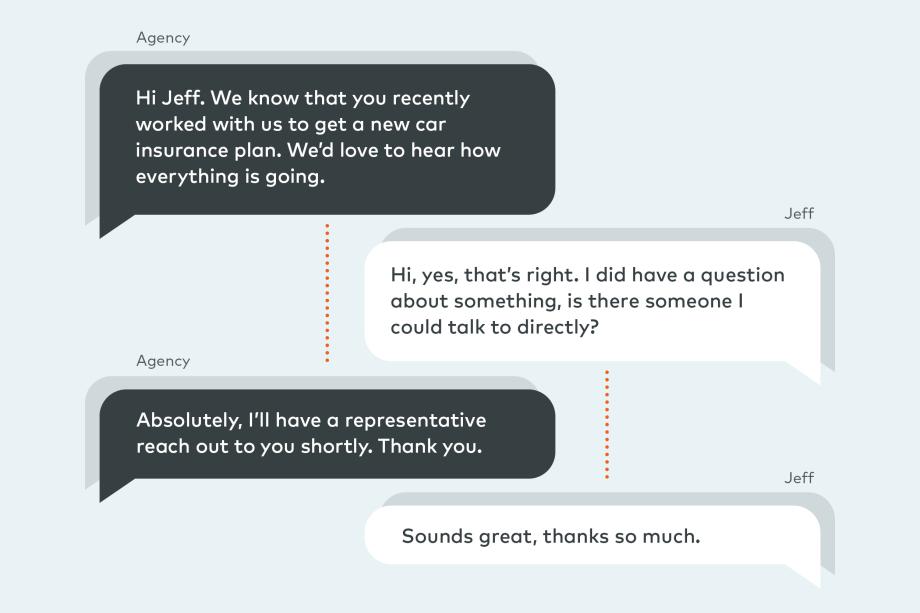

According to a July 2021 report “Optimizing the Independent Agent Experience” conducted by research and advisory firm Celent, 80% of respondents indicated it's important to provide policyholders with self-service tools. End-insureds still want to speak to an insurance agent or CSR for risk advice or for answers about their specific needs. However, they also want to access routine information on their own schedule, without waiting for regular business hours or “the next available agent.”

Harnessing InsurTech to solve the most common challenges

There are a variety of reasons agencies are implementing chatbots to improve their customer service experience including:

- Fulfill most common tasks: Chatbots can easily assist clients with the most common questions and concerns they have about claims and payment methods.

- Accumulate leads: When clients interact with a chatbot, they may be asked to fill in basic contact information such as name and email address, which is a simple and effective way to gather customer data and generate leads. This information can be shared with the sales teams for use in future outreach.

- Utilize as an education tool: For a lot of people, insurance can be complex and difficult to understand; and often times, a client will reach out to their agency with a question about a product or process. A chatbot can usually answer these questions and provide clarity or direct those inquiries to the right resource.

- Gain valuable insights on customer trends: Chatbots also offer a way for an agency to easily compile data on their various customer service inquiries. For example, if multiple customers are having trouble navigating a certain part of an agency’s website, the chatbot data can help the agency pinpoint where to invest in site improvements.

- Improve brand loyalty: People want to feel like they’re engaging with a company that understands their needs and concerns. Providing customers with the form of communication they desire can help an agency build brand loyalty. With that in mind, it is also important that agencies always include a way for customers to contact real humans if needed. There are still people in the world who don’t want to interact with a chatbot and always prefer to talk to a representative during normal business hours. Having both options available will achieve a customer service balance in a rapidly changing world.

- Free up employees: Since employees aren’t spending time handling customer service inquiries, they will have considerably more time to focus on complex matters that require human intervention.

An improved client digital experience is the future of modern insurance

Chatbots are still a relatively new technology in the insurance industry, and many companies naturally have concerns regarding the tech. As with any online messaging platform, two critical challenges include ensuring the security of client data and minimizing risks associated with impersonation of individuals that can lead to phishing scams or malware attacks.

Also, chatbots won’t and shouldn’t replace all communication with clients. For example, chatbots are not the best solution for managing customer grievances.

In an industry where the customer experience is first, second, and third on an agency’s list of top priorities, chatbots will likely continue to be embraced by insurance professionals looking to meet their customer’s evolving expectations.