Unclear market position

Limited insight into product pricing

Measuring new market viability

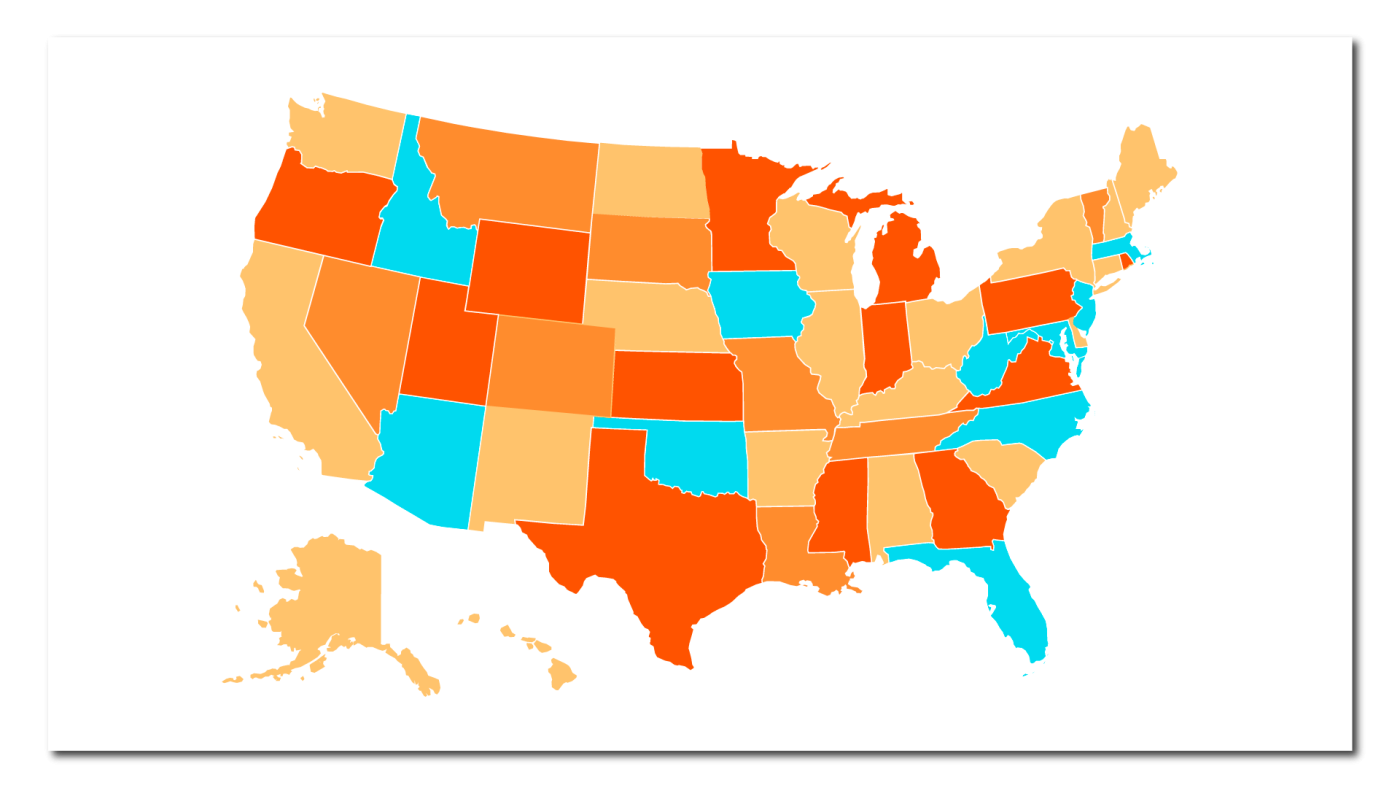

Clarify your market presence

See where you’re winning—and what to focus on next.

Our insurance data & analytics solutions bring together anonymized data from thousands of agencies to deliver reliable market share visibility across lines of business, geographies, and market segments. With this broader intelligence, carrier teams can identify performance gaps, validate strategic decisions, and uncover opportunities for profitable growth with greater confidence.

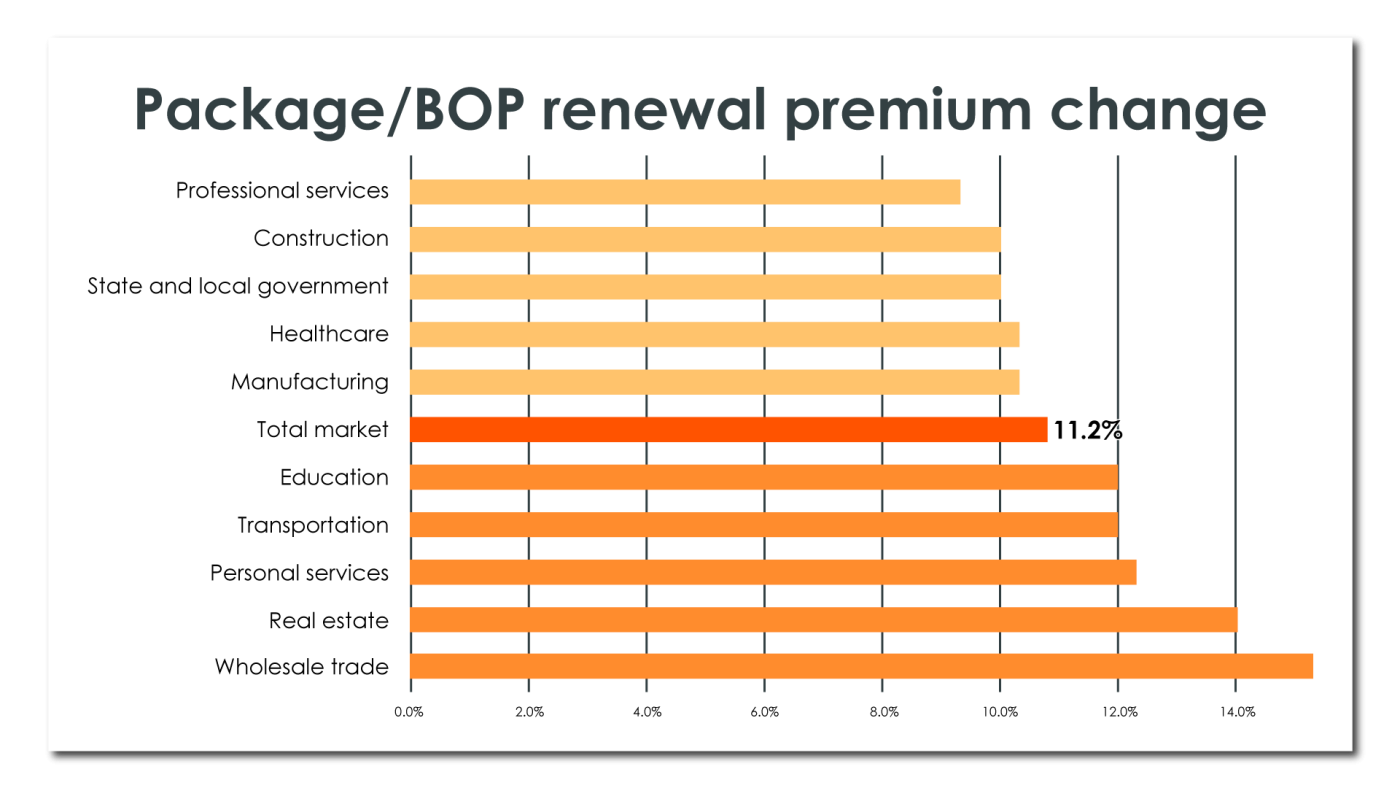

Price with confidence

Know how your pricing compares—and act decisively.

By surfacing aggregated quote activity, premium changes, and marketplace trends, our solutions help carriers benchmark pricing and better understand how their strategy aligns with market conditions. These insights strengthen risk analysis and reduce guesswork, enabling teams to respond more effectively as pricing dynamics shift.

With Mutual Capital Analytics (MCA), carriers can also apply forecasting tools to test scenarios, evaluate pricing impacts, and make more informed pricing decisions.

Identify emerging opportunities

Expand into the right markets with data-backed confidence.

Our insurance data & analytics solutions provide visibility into emerging market dynamics, agency distribution channels, and growth trends across personal and commercial lines. Through deeper agency data analysis, carrier leaders can assess sustained demand, evaluate alignment with risk appetite, and confidently prioritize expansion opportunities that support long-term, strategic growth.

Where our data comes from

The insights we bring you stem from an expansive collection.

-

3,400+ agencies

-

21+ million policies

-

$122B in premium value

Data & analytics solutions

Frequently Asked Questions

How do Vertafore and MCA help carriers understand their market share?

View More

Vertafore’s insurance data analytics solutions consolidate anonymized agency data to reveal how carriers are positioned across regions, industries, and partners. For carrier seeking deeper insight, MCA provides data visualization and comparative analytics to further clarify market share and opportune areas.

Can data analytics solutions help me evaluate product pricing?

View More

Yes. Our data foundation surfaces real marketplace signals such as rate trends and aggregated quote data to support stronger price evaluation and strategies. MCA extends this with impact analysis and benchmarking tools, so you can understand how your pricing aligns with the market.

What types of customer churn can carriers gain insight on?

View More

By analyzing anonymized agency activity, carriers can identify behavioral patterns and appetite shifts, as well as market pressure that may indicate churn risk. MCA offers churn modeling and behavioral analytics, so organizations can build and refine their long-term retention strategies.

How do insurance data analytics solutions support distribution strategy?

View More

These solutions help carriers better understand where business is being placed, which agencies align with their appetite, and how performance compares across segments. By combining Vertafore’s broad data visibility with MCA’s enhanced insurance business intelligence, carriers can make more strategic decisions about engagement and resource allocation.

Do I need both Vertafore’s tools and MCA to benefit from these insights?

View More

Not necessarily. Vertafore provides core market intelligence that helps carriers with visibility, benchmarking, and foundational risk analysis. MCA is available for carriers that need a jumpstart to their data initiatives and want to go even deeper through the use of modeling, forecasting, and indexing tools which offer an added layer of analytical depth. However, if not using MCA, carriers can still feed the data from Vertafore’s tools into their own business intelligence solutions.

Not necessarily. Vertafore provides core market intelligence that helps carriers with visibility, benchmarking, and foundational risk analysis. MCA is available for carriers that need a jumpstart to their data initiatives and want to go even deeper through the use of modeling, forecasting, and indexing tools which offer an added layer of analytical depth. However, if not using MCA, carriers can still feed the data from Vertafore’s tools into their own business intelligence solutions.