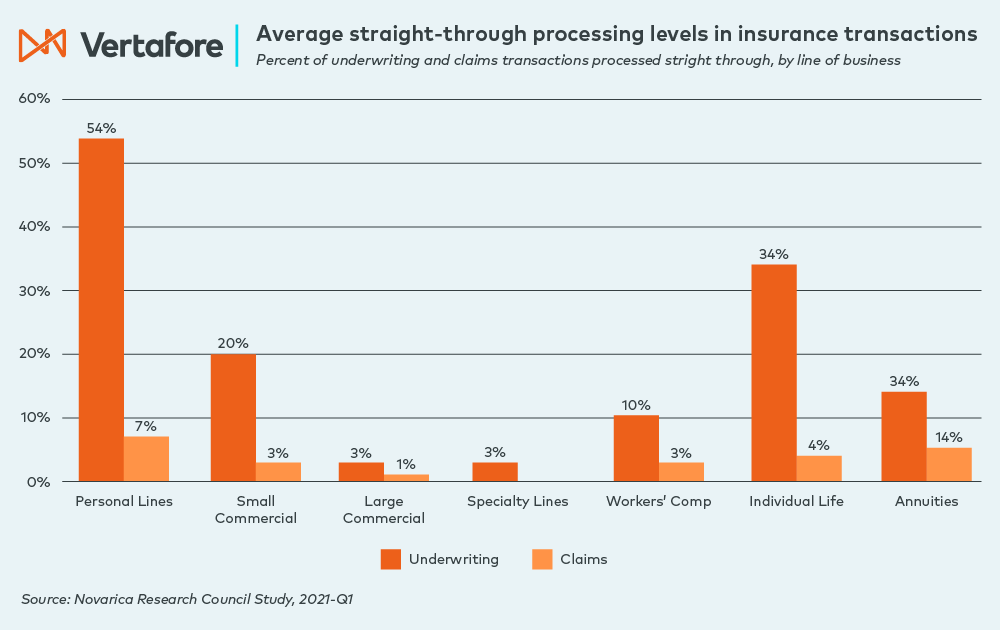

Straight-through processing (STP) is an established business concept centered on automating entire processes from start to finish, without the need for repetitive, manual rekeying of data. By digitizing complex, information-based workflows, STP improves efficiency, accuracy, and both the customer and agent experiences. For the insurance industry, STP is notably beneficial to the underwriting and claims lifecycles, especially in personal lines.

Greater efficiency

Straight-through processing reduces or eliminates manual data entry, which means faster processing times and increased growth capacity for carriers and MGAs. The overall accuracy for data exchanges also improves because STP minimizes the risk of manual input errors or omissions that can often cause delays. Familiar digital tools such as “autocomplete” or “required fields” can prevent such mistakes from occurring on applications or claims forms.

This level of automation results in faster underwriting and claims processing wherein eligible policies can be approved immediately, and routine claims can be settled more efficiently. Additionally, agents are free to focus on more complicated cases: through exception-based processing, 80% of the value of human judgment comes from just 20% of cases.

Empowered agents

Independent agents benefit from straight-through processing given that the reduced demands of administrative tasks allow them to better fulfill their most critical role as customer advocates and advisers. This is especially important during claims, which are typically the defining moment in a customer’s relationship with a carrier. To successfully manage claims, a strong relationship between independent agents and the end-insured is vital; STP makes it simpler for agents to access the information they need to provide meaningful customer support and status updates.

Read also: Improving agent digital experience – The necessity of easy access to assistance

Data-driven insights

The automation at the core of straight-through processing improves data capture and exchanges, which gives insurers access to up-to-date, reliable business intelligence. This connectivity data can serve as a valuable resource for decision-making, strategic planning, and immediate insights into operational trends. Such insights are crucial for staying competitive in the marketplace.

Read also: Discussing data culture in insurance

Easier regulatory compliance

Increased automation via straight-through processing also makes it simpler to maintain proper regulatory compliance across organizations and thus lower the risk of costly fines. STP-enabled systems can be updated quickly to reflect changes in regulations and apply new requirements consistently. This prevents situations where an agent might misunderstand or be unaware of a new regulation and veer into non-compliance. According to the NAIC’s annual Insurance Department Resources Report, nearly one in four insurers faced a financial and market conduct exam in the most recent year for which figures are available. As a consequence, these insurers paid hundreds of millions in total penalties and fees for failing to meet regulatory requirements.

Read also: How compliance automation helps carriers reduce the risk of regulatory fines

More streamlined insurance operations

As applications and claims increase, insurers must adopt reliable processes to increase their efficiency and better empower their agents to support end-insured customers. Straight-through processing offers a practical approach to streamlining insurance operations with connectivity benefits that extend across the insurance ecosystem. By eliminating manual processes, improving data accuracy, and ensuring greater compliance, STP can increase growth opportunities for many carriers and MGAs.

Learn more about Vertafore’s forward-looking solutions with proven results.