Hyland Insurance is an independent insurance agency founded in 1983 by brothers Tim and Pat Hyland. The agency has since expanded to become one of the leading agencies in the Louisville, Kentucky Metro Area. Hyland’s mission is to build trust to provide success and security to their 7,000-plus individual and business clients.

Background

As with most businesses, Hyland was faced with some challenges in 2020. The pandemic shifted the workplace dynamic as well as the client-agency relationship the insurance industry is known for. To stay relevant and profitable, this family-run agency doubled down on their top priority: providing high level service to their customers.

This customer-forward thinking comes in the form of not only adopting technology but ensuring that technology integrates seamlessly together for an optimal employee and client experience. “It’s always been very important to us to embrace new technology,” says Hyland COO, Jeffri Northcut. “It’s been our focus to have all our technology in one spot so that it’s easy to service our customers.”

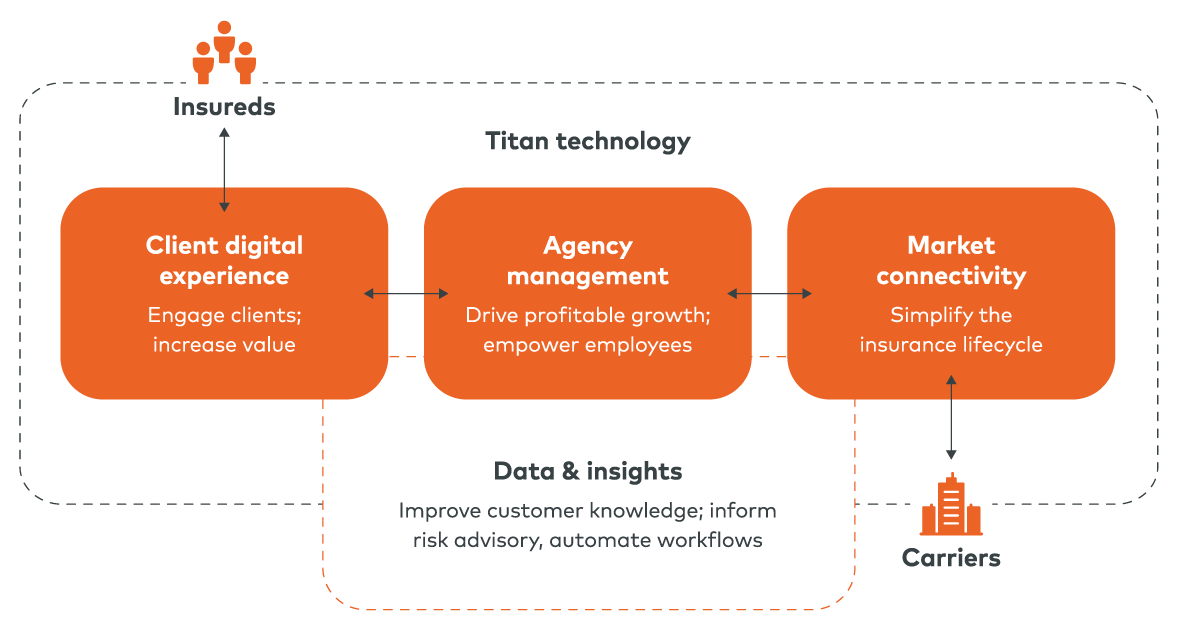

Vertafore’s suite of client digital experience and agency management products gave Hyland a leg up on their competition and made dealing with the effects of the pandemic easier.

SET FOR SUCCESS

Vertafore solutions

Proven results

- Seamlessly transitioned to remote work in wake of the 2020 pandemic

- Implemented completely paperless processes

- Freed up time for staff through automation and self-service offerings

Paperless process

“I think we had 48 hours to get everybody out of the office and set up at home,” Marketing Manager, Melissa Stewart says regarding the stay-at-home orders in March of 2020. “Not everyone had laptops, so it wasn’t an easy task. But it was so helpful to already have our technology in place and the feeling that we were able to turn it on immediately.”

AMS360 and eDocs allowed Hyland to remove all paper processes in the agency — a key to sustained productivity throughout the pandemic, according to Stewart. During a time when retrieving physical documents from the office was impossible, Hyland didn’t have to worry about not being able to protect their customers from risks.

“eDocs was a huge lifesaver through all of this,” Stewart adds. “We have everything downloading through TransactNOW for our participating carriers.” Hyland no longer has a dedicated staff member scanning in documents and emailing them to each client manager, saving heaps of time for the agency. But another benefit Stewart points out is the simple fact that she has a clean desk. She says, “Getting rid of all that paper on your desk de-clutters your mind as well and makes you feel more in control of your work."

Enjoyable customer experiences

Possibly one of the most challenging aspects of today’s remote work is maintaining strong ties with clients. In an industry heavily focused on personal relationships, agencies are striving to cultivate these connections in an entirely new way.

Hyland relies on InsurLink, a self-service portal, to provide clients with the same level of service and personal touch they’re used to, all online. It provides a modern, intuitive client digital experience allowing Hyland’s insureds to access policy information, retrieve certificates, or even pay their bills from any device.

Hyland adopted InsurLink long before the pandemic. As a growing multi-state agency, they needed a way to provide top-notch service to every client. However, COVID-19 has created an increased need for customers to digitally self-service. Northcut says, “If they need to get certificates or anything, it’s easy to log in and get what they need outside of business hours. They love it.”

And with the InsurLink mobile app, insureds can enjoy the freedom of knowing they have the power of their insurance agency at their fingertips.

No one feels overwhelmed or behind. The automation, the tools, and the integration all help us be more proactive.

– Jeffri Northcut

COO, Hyland Insurance

Hyland didn’t stop at providing self-service for their customers. They also adopted Vertafore Orange Partner, Agency Revolution, to stay top of mind and ensure clients are receiving the coverage and service they need. “When our customers think ‘insurance’, we want them to think Hyland,” Northcut says. “No one else.”

Agency Revolution’s marketing automation sends communications for events such as welcoming a new client or wishing them a happy birthday. Stewart says, “We chose to add Agency Revolution for win backs, marketing to our existing customers, and just keeping in touch.” Hyland can focus on selling and servicing while Agency Revolution helps maintain the brand and personal relationships with clients.

Northcut adds that the integration between all their Vertafore products and partner solutions has made a lasting impact on Hyland’s processes. She says, “No one feels overwhelmed or behind. The automation, the tools, and the integration all help us be more proactive.

More than software

Vertafore offers Hyland so much more than a suite of integrated technology solutions. Northcut and Stewart can count on their every need being met with the help of their own dedicated account manager.

“It’s nice that we have a local Vertafore representative that we can easily contact,” says Stewart. “She knows us, she knows our area, and she knows the types of customers we have. She can recommend solutions and help us with growing the business. We rely on that relationship quite a bit.”

Vertafore takes a consultative approach to helping customers achieve their goals. In Hyland’s case, that means product recommendations, growth strategies, or even the latest industry trends and how to adapt to them.

Innovative solutions for the modern agency

Insurance is evolving: The industry is quickly consolidating, client expectations are growing, and technology is creating new opportunities. The key is staying ahead to remain relevant and profitable. If you’re unsure how to move forward in this evolving landscape, Vertafore is here to be your partner and guide you through these changes.

Ready to take the next step?

Contact us to learn more about how Vertafore can help you

foster client engagement and drive productivity.

Posted August 11, 2023 in Success Stories