XPT Specialty is a wholesale brokerage and binding firm that connects insurance professionals with specialized solutions across multiple industries. They pride themselves on working collaboratively to find the right answers for insurance clients. Backed by decades of commercial insurance experience, their specialist experts understand niche markets and have their finger on the pulse of the industry to identify new markets and emerging tech.

About

The modern wholesaler’s outlook

Today’s wholesale and MGAs market is a balancing act under pressure. Rising costs, fast-shifting and complex compliance requirements, the speed-to-market push, and the need to deliver for their clients is forcing firms to rethink how they operate. To thrive, they must simultaneously build:

- Strategic partnerships with agency clients, carrier partners, and InsurTech providers.

- A connected technology ecosystem that supports data integrity, seamless workflows, and efficient processes.

Using insurance technology to make a difference

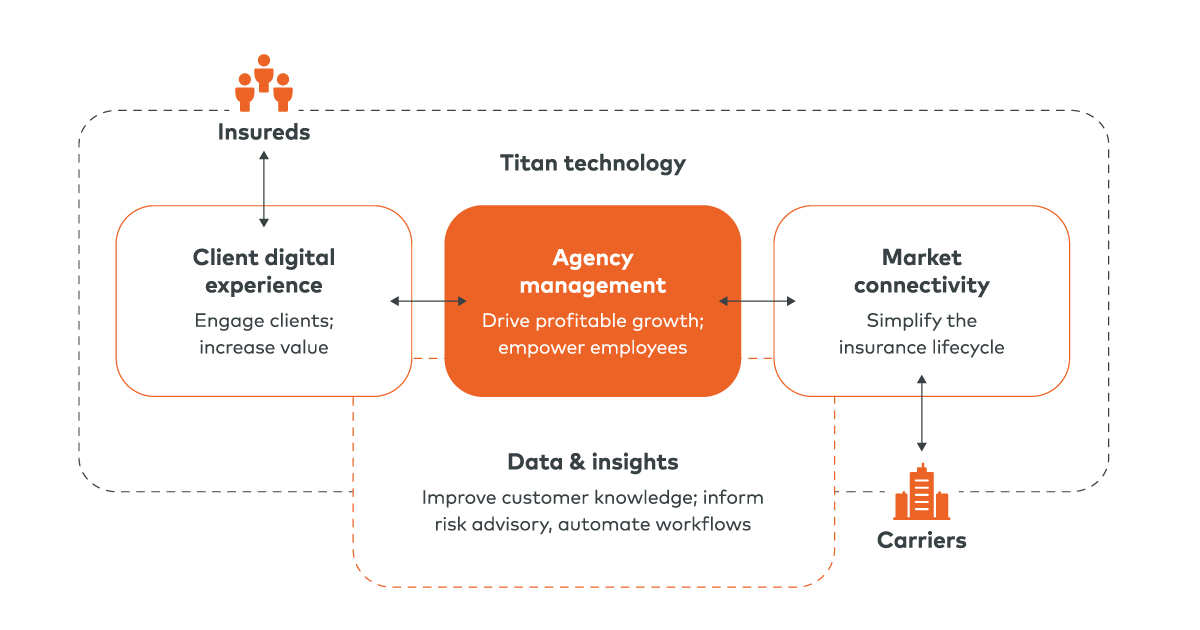

XPT Specialty is meeting those challenges head on. As a wholesale brokerage and binding firm that connects insurance professionals with specialized solutions across multiple industries, XPT has made deep technology integrations a core part of its strategy, and it is committed to fostering technology partnerships and integrations that support the company’s growth and the entire industry’s success. By partnering closely with industry leaders like Vertafore, the company has streamlined quoting, improved data accuracy, and reduced manual work for agents and carriers alike.

At XPT Specialty, innovation and collaboration aren’t just buzzwords—they’re fundamental to how we operate and succeed. We believe technology should make complex tasks simpler, empowering our teams to serve retail agents, carriers and other partners faster and better.”

Ed Forer, Chief Administrative Officer, XPT Specialty

XPT defines and delivers on partnership

Building a true partnership requires an ongoing commitment to collaboration across the entire insurance marketplace. Upholding this forward-thinking philosophy, XPT Specialty prioritizes the needs of its retail agent clients, carrier partners, and brokerage community. To do so, XPT has taken the lead, working with technology partners like Vertafore to build integrations between their systems, and enabling stakeholders to get greater value from their solutions. By fostering an open and integrated ecosystem, XPT is multiplying value for all parties and cementing its position as a genuine innovator and leader in the insurance industry.

Creating value through collaboration

XPT’s technology leadership

XPT is setting a standard in the industry by working with technology partners like Vertafore to build integrations between their systems. XPT led the way as an early tester and adopter for numerous initiatives, such as the integration between AIM and Surefyre to facilitate faster quoting and a better experience for retail agencies.

XPT is creating a connected ecosystem that eliminates duplicate entry, speeds up submissions, and safeguards information from start to finish. The end result: The wholesaler is enabling stakeholders to get greater value from their solutions and paving the way for sustained growth.

Vertafore solutions

The value of working with Vertafore

Innovative technology is only a true advantage when it powers unwavering data integrity. This philosophy has guided XPT’s integrations with Vertafore’s AIM, NetRate, Surefyre, and ImageRight—creating a connected ecosystem that eliminates duplicate entry, speeds up submissions, and safeguards information from start to finish.

XPT has been an outstanding collaborator in connecting the full power of our solutions to enable MGAs and wholesalers to respond quickly to market needs. We’re proud to honor their leadership, their spirit of innovation, and their commitment to our industry.”

Rick Warter, Chief Customer Officer, Vertafore

Redefining the competitive advantage

XPT Specialty’s success offers a new blueprint for wholesale brokerages. Instead of guarding its competitive advantage, the company’s growth strategy is to create value by solving friction between systems and sharing those solutions with others. This approach proves that the future of insurance lies not in closed systems, but in open, collaborative partnerships that drive success across the entire industry.

I enjoy explaining how we solved a problem that I know everybody has. If I can come up with a solution that helps us, it may help somebody else in the industry. It’ll eventually benefit other systems, other software, and other solutions, and become a feature that makes a task easier. It becomes a standard way of doing things.”

Marc Stevens, SVP – IT and Operations, XPT Specialty

Partnering on integrations that drive speed to market

In 2025, Vertafore recognized XPT Specialty with the 2025 Speed to Market Innovator Award. The award celebrates MGAs and wholesale brokers who are at the forefront of accelerating the delivery of insurance products into the marketplace through strategic integrations across Vertafore’s ecosystem of solutions.

XPT was nominated for working closely with Vertafore to build deep technology connections that accelerate their speed to market. XPT has led the way as an early tester and adopter for numerous initiatives, such as the integration between AIM and Surefyre to facilitate faster quoting and a better experience for retail agencies.

“Receiving the Speed to Market Innovator Award is affirmation that we’re effectively delivering solutions that not only help us, but drive efficiency across the wholesale industry,” said Ed Forer, chief administrative officer at XPT Specialty.

XPT’s commitment to the industry earned the wholesaler Vertafore’s 2025 Speed to Market Innovator Award, presented at Accelerate.